About 10 weeks into our school year, our 7th graders were given the following driving question: “Based on the current financial trends, how can I create a financial portfolio that will allow me to be a financially responsible citizen?”

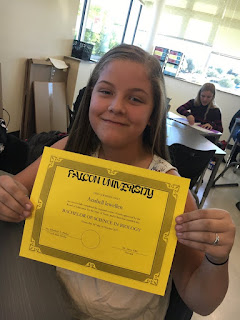

Prior to our kick off, learners were given a survey, using Google forms, where each learner chose their top 3 STEM careers. We used this data to help create our groups! Students were curious why they had to complete this survey and on Monday, October 16, they each graduated from Falcon University with a bachelors degree. Our academic coach, Mary Terry, arrived in our classrooms, with a special delivery...their college degrees! The ceremony wouldn't have been complete without pomp and circumstance playing and shaking each of our graduates' hands.

Upon our graduation ceremony, our learners were given the standards that we would be covering during the course of the next two weeks. Individually, learners annotated their page, creating their individual Knows & Needs to Know chart. We progressed to making a class Knows & Needs to Know chart through scaffolded questioning.

As a 7th grade PLC, we loved how this chart guided our daily instruction and how enthusiastic our Falcons were when it came to moving items from the Needs to Know side to the Knows side. Learners were truly owning their learning!

As part of their first day of life beyond college, learners were given the challenge of creating their financial portfolio, which was a pocket folder, where all of our learning would be documented! After their first "day" of work, each learner was paid. Learners quickly realized that a large percent of their earnings were taken away to cover health insurance, savings and taxes.

|

| This was a Google Slide from one group's PSA that explained how to use WOCN when working with percents. |

Our Falcons were amazed at how much a $50,000 F-150 actually cost! Mr. Fichter brought actual finance documents and learners analyzed them.

As we continued throughout the month of October. learners were given various opportunities to apply their knowledge of percents to budgeting and purchasing a car! We were fortunate that one of our 7th grade teachers is married to a car manager at an area car dealer, so he shared his current inventory with us. Based on this data, we created several learning opportunities for our Falcons. The first real world application was a gallery walk called "Walk the Lot." This activity focused on the interest charged on various car loans.

Here is a sample problem from Walk the Lot:

You have decided to purchase a black 2016 Cadillac Escalade with 24,899 miles. The purchase price is $66,742. If you finance the entire amount at a simple interest rate of 6% for 5 years, how much interest will you pay? What will be the total amount you pay for the Escalade?

Our learners also discovered which monetary incentives were the best for them, based on their knowledge of their net pay and interest on loans.

As we grew closer to determining a financial solution to alleviating debt, learners were allowed to "Supe Their Ride," a spin off of the reality tv show! They were given the option of upgrading the sound system, adding rims, having leather or cloth seats, just to name a few. This gallery walk allowed learners to continue working with tax, commission and discounts in various situations. They absolutely loved designing their vehicle, but quickly learned priorities needed to be made when making such an important financial decisions!

As we moved into November and our Falcons had experienced several learning opportunities involving percent application, they were let loose to create their financial PSA, based on the task given to them by Mr. Fichter! Some utilized Google Slides, while others stepped out of their comfort zone and used the green screen room in our learning commons. We loved watching them beam with pride as they created and shared their PSAs with their classmates!

- we got to make a movie/slide show

- how we work in groups

- picking our car that fits best into the budget

- Thank you for making math fun!

- Having a guest speaker in math was cool.

From the survey we gave to our parents, we received this feedback:

|

| Google Form Survey sent to our Falcon parents |

The three top lessons, that sparked the most conversation at home, were:

Day 2: My First Paycheck

Day 4: Fixed vs. Variable Expenses

Day 7: Mr. Fichter speaks at NRMS

In January 2018, we met with our district math coordinator to reflect on our first PBL. Based on the rubric provided from NISE, we drew the following conclusions:

Standards/TEKS

- We need to spend less time on Compound interest. We can use technology to interactively demonstrate the difference between simple and compound interest. We all agreed that we should use the WON strategy when we begin our unit of proportions, rather than wait until we begin percents.

Driving Question & Entry Document

- Our question needs to be more open ended and broader. We need to give our entry document (letter from 5 Star Ford) earlier, so students have time to process the task and be prepared to ask questions!

Technology Integration

- We would like to start the digital presentations earlier, which would entail before or after school opportunities. To integrate technology throughout our PBL, we would like to add a digital choice board of activities that encourages learners to create various artifacts and allows them to use other digital tools. We also thought we could have students do more research as far as pricing of vehicles, rather than just give them the information. Another extension included utilizing Google Sheets to show how formulas are used and graphs can be created!

- We need to provide tutorials for our learners about the technology we'd like for them to utilize. We'd like to include a webquest next year to enhance our students' learning

Culminating Product

- Due to the number of students who used Google Slides, we'd like to encourage other presentation options. In order to allow enough time with technology, we as teachers agreed that we need to open up the computer lab or maker space before and after school. We also thought about having the students present in class and be recorded, which could be displayed elsewhere.

Overall the 3.5 weeks of learning that took place during the fall of 2017 were worth the hours of planning and reflecting! I'm proud to work with a team of educators who stepped out of their comfort zone and put their heart and soul into making this experience so meaningful for our Falcons! We new we were moving in the right direction, as a 7th grade team, when our CBA data came back and showed growth is the standards are PBL covered. It was just the motivation we needed, as we began planning our next PBL, which was implemented in March!

No comments